Abstract

The number of diesel cars in Europe has grown significantly over the last three decades, a process usually known as dieselization, and they now account for nearly 40% of the cars on the road. We build on a dynamic general equilibrium model that makes a distinction between diesel motor and gasoline motor vehicles and calibrate it for main European countries. Firstly, we find that the dieselization can be explained by a change in consumer preferences paired with the productivity gains from the specialization of the European automotive industry. Secondly, the lenient tax policies in favor of diesel fuel help to explain the rebound effect in road traffic. Finally, from a normative standpoint, the model suggests that a tax discrimination based on the carbon content of each fuel (higher for diesel relative to gasoline) would actually be more effective in curbing \({\text {CO}}_{2}\) emissions rather than a tax based on fuel efficiency. Based on the existing studies, we also document that other external costs of diesel are always higher than those of gasoline, and the Pigouvian tax rates should reflect this aspect. This recommendation is radically different to the existing fuel tax design in most European countries.

Similar content being viewed by others

1 Introduction

The composition of the passenger car fleet has been transformed in Europe over the last few decades. Diesel cars accounted for a minor part of the fleet at the beginning of the 1980s and nowadays represent more than 40% of the total EU fleet, a process referred to as dieselization.

The choice between a gasoline versus a diesel car is a key factor in a consumer’s decision when purchasing a new car. Nowadays, when comparing certain important vehicle attributes, such as speed, safety, size, design or horsepower, there are hardly any substantial differences between the two types of vehicles. But in terms of fuel efficiency, diesel cars consume, on average, about 17% less fuel per kilometer than gasoline cars (Verboven 2002).

An additional aspect that is likely to be behind the popularity of diesel vehicles is related to the fuel tax policy implemented by most European Governments over the last decades. As early as in 1973, the European Economic Community adopted the European Fuel Tax Directive. Most European governments have been more lenient with diesel fuel, generating an extra incentive to use diesel motor cars.Footnote 1 European governments have usually put forward two arguments to defend this discriminating tax policy in favor of diesel: first, the gains in energy savings; second, because diesel is more efficient, a reduction in \({\text {CO}}_{2}\) emissions was expected (Schipper et al. 2002 or Sullivan et al. 2004, among others). However, the success of dieselization as a measure to control \( {\text {CO}}_{2}\) emissions has been questioned by many authors in the literature surrounding Transport Economics, such as Schipper (2011), Schipper and Fulton (2013), González and Marrero (2012) or González et al. (2019).

In this paper, we explore the conditions under which the dieselization holds and its consequences on road traffic and \({\text {CO}}_{2}\) emissions. We address these issues by building a dynamic general equilibrium (DGE) model taking into account the decisions surrounding the purchase and usage of a car (Wei 2013), together with the generation of \({\text {CO}}_{2}\) emissions and its external effects on climate change (Golosov et al. 2014). More precisely, we build on a neoclassical framework with a representative household, whose utility is determined by their amount of leisure, consumption of non-durable goods and the services provided by diesel motor and gasoline motor automobiles. Both automobiles are powered with their corresponding (non-substitutable) fuels. When households make vehicle purchase decisions, the price of new vehicles reflects fuel prices and fuel taxes. The choice between a gasoline car or a diesel car is made optimally. However, once this decision is made, the type of fuel cannot be changed, while taxation can be altered by fiscal authorities. As we show, this fact produces different short-run and long-run price elasticities of fuel use. Additionally, motor vehicle users do not perceive the effect of their own choices over climate change, as competitive prices fail to inform about the external costs of using vehicles. Moreover, the effects of \({\text {CO}}_{2}\) emissions are long lasting. Notice that this sort of issues cannot be addressed using a traditional discrete choice analysis.Footnote 2

We calibrate the economy of 13 EU countries and find that the model produces demand elasticities similar to those reported by empirical studies. In a model validation exercise, we conclude that the bulk of the dieselization could be associated with consumer preferences paired with the productivity gains from the specialization of the European automotive industry. Indeed, the popularity of diesel vehicles is a peculiar feature of the European auto market (Miravete et al. 2018). On the contrary, we find that, at the very best, policy decisions affecting fuel taxes and the sale price of new vehicles (such as VAT, registration fees or replacement subsidies) could account for around 8% of the increase in diesel vehicles between 1999 and 2015 in Europe. However, given the stock of diesel and gasoline cars, we show that fuel taxation can help to explain the higher mileage of diesel vehicles, fuel consumption and  vehicle emissions in Europe.

vehicle emissions in Europe.

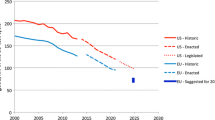

The second aspect addressed in this paper is normative and deals with the optimality of the tax policy implemented in Europe. Parry et al. (2007) identify several vehicle externalities, such as noise, congestions, accidents, local pollution and global warming. In this paper, we only focus on \({\text {CO}}_{2}\) emissions, which can justify a different tax treatment between diesel and gasoline cars. \({\text {CO}}_{2}\) emissions of fuel combusted depend on the carbon content per liter of fuel (US Environmental Protection Agency (EPA) 2011; Santos 2017). For European countries, Santos (2017) reports carbon contents that are always greater for diesel than for gasoline fuel, by factors ranging from 5 to 29%, depending on the country.Footnote 3

We obtain that the Pigouvian taxation of each type of fuel must be proportional to the amount of carbon emissions of the fuel. When we consider \({\text {CO}}_{2}\) as the only externality, we estimate the Pigouvian tax rates to be 1.83 Euro cents per liter of diesel and 1.60 cents per liter of gasoline, which is equivalent to imposing a tax of about 25 Euros per ton of carbon. In addition, Pigouvian taxation would require a 0% sale tax on new purchases of cars to internalize the external costs of \({\text {CO}}_{2}\) emissions. Both results are at odds to the policy of dieselization implemented during the last decades in most OECD countries.

We also solve numerically the model under two alternative tax regimes: the Pigouvian tax regime and one consistent with the dieselization in Europe. Based on our simulations, we show that the current tax design in Europe has caused an increase in traffic density by 2.7% and in \({\text {CO}}_{2}\) emissions by 2.4% in excess of those levels obtained under the Pigouvian scenario.

To our knowledge, this is the first paper addressing all these issues related to dieselization using a DGE model. Wei (2013) is probably an exception in using a similar theoretical framework, analyzing the consequences of Corporate Average Fuel Economy (CAFE) standards on gasoline consumption and miles driven in the USA. By contrast, in our paper, we take fuel efficiency as given and focus on the diesel–gasoline decision taken by a representative household. Our model is linked to a broad range of topics. Given that we deal with the external impacts on global warming, we extend some ideas from Nordhaus and Boyer (2000), Nordhaus (2008), Golosov et al. (2014) and Hassler et al. (2016) concerning the carbon cycle and adapt them to \({\text {CO}}_{2}\) emissions from passenger cars. The articles by Fullerton and West (2002) and Parry and Small (2005) share with ours a common interest of optimal (gasoline) taxation. By contrast, we incorporate dynamic aspects which help understand driving and purchasing decisions, fuel consumption and total kilometers driven.

The paper is structured as follows. The second section presents evidences describing the evolution of the vehicle fleet, fuel consumption and \({\text {CO}}_{2}\) emissions of cars in our set of EU 13 countries. The DGE model is established in the third section. In the fourth section, the market equilibrium and the social planner problem are solved. In the fifth section, the model is calibrated for an aggregate economy of a set of representative European countries. Using this calibration, a model validation exercise is performed and the Pigouvian taxation is quantified. Next, the model is numerically solved and \({\text {CO}}_{2}\) emissions and welfare are evaluated from moving from a steady-state equilibrium consistent with the dieselization in Europe toward the Pigouvian allocation. Conclusions are summarized and presented in the last section.

2 The dieselization process in Europe

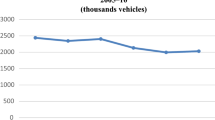

We first report evidence of the sharp increase in the share of diesel-powered vehicles in Europe. Data on fuel consumption (equivalent million tons of oil), car stock and sales of new cars (millions), kilometers driven (km-travelled/car-year), fuel efficiency (l/100 km.) and \({\text {CO}}_{2}\) emissions (Mt. \({\text {CO}}_{2}\)) come from the Odyssee-Mure database.Footnote 4 Data are collected and aggregated from the following 13 western EU countries (henceforth, EU13) from 1998 and 2015: Austria, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, Spain, Sweden and the UK. These economies accounted for about three quarters of European GDP in 2015.

Figure 1 reflects the intensive dieselization process that took place in these European countries between 1998 and 2015. The percentage of diesel cars increased from 16.5% in 1998 to 42.4% in 2015. Similar patterns are observed when looking at the ratios of new cars registrations and fuel consumption of passenger cars. Except for Greece, these ratios rose in all EU countries during this period. For example, Austria, Belgium, France, Portugal, Spain or Italy, currently holding the highest proportion of diesel cars, have shifted from ratios of between 22 and 52% in 1998 to ratios between 64 and 71% in 2015.

Figure 2 represents the average number of liters of fuel needed per 100 km for diesel and gasoline cars (i.e., the inverse of fuel efficiency) from 1998 to 2015. As of 2015, while a diesel motor car burned about 6.40 l of fuel per 100 km, a gasoline motor car burned 7.5 l on average, i.e., 17% more. Fuel efficiency has improved in both types of cars. Hence, there is the advantage in fuel efficiency of diesel cars over gasoline cars. On the other hand, most European Governments have implemented a tax policy favoring diesel over gasoline. Figure 3 shows the evolution of the average prices of gasoline and diesel in these countries (with and without taxes) from 1998 to 2015. While the price of both fuels (net of taxes) has evolved evenly during this period, the price of gasoline is about 20% higher on average than that of diesel for the whole period when taxes are included.Footnote 5

As already discussed in Introduction, regarding the impact of dieselization on the road transport sector, Transport Economics has been far from consensus. On the one hand, some authors, such as Sullivan et al. (2004), Rietveld and Van Woudenber (2005), Zervas (2010), Zachariadis (2006) and Jeong et al. (2009), have argued that the dieselization could be used for energy saving and to curb \({\text {CO}}_{2}\) emissions. On the other hand, the suitability of dieselization for these two roles has been called into question by other authors, such as Schipper et al. (2002), Mendiluce and Schipper (2011) and Schipper and Schipper and Fulton (2013). Marques et al. (2012) found that the reduction in \({\text {CO}}_{2}\) emissions from diesel vehicles (due to the higher fuel efficiency) was outweighed by the increase in kilometers driven (due to the rebound effect). Similarly, González and Marrero (2012), using a sample of 16 Spanish regions between 1998 and 2006, concluded that the (negative) impact of the rebound effect was greater than the (positive) effect of energy-efficiency gains. More recently, in the same vein, González et al. (2019), for a sample of 13 European countries from 1990 to 2015, provide evidence that \({\text {CO}}_{2}\) emissions have benefited from global technological progress and changes in average fuel efficiency, while increases of economic activity, motorization rate, and the dieselization process hold a positive and significant relationship with car \({\text {CO}}_{2}\) emissions.

To understand why this second set of results can occur, a first factor to consider deals with the higher carbon content per liter of diesel (EPA 2011; Santos 2017). This partially offsets the fuel efficiency in diesel-powered cars. On average, the \({\text {CO}}_{2}\) emissions generated per liter of diesel are 2.72 kg, which is 14.5% higher than the amount of \({\text {CO}}_{2}\) emissions generated when consuming 1 l of gasoline (2.35 kg of \({\text {CO}}_{2}\) ). Thus, \({\text {CO}}_{2}\) emissions per kilometer driven in a diesel car are just \( 2.5\%\) higher than those generated in gasoline cars. A second factor is that the dieselization process may imply an increase in total kilometers driven. Due to the fact that diesel cars are more efficient (in terms of liters per km driven) and its fuel is cheaper (in terms of euros per liter), diesel cars are driven more intensely than gasoline cars. Figure 4 shows that the average number of kilometers driven by gasoline and diesel cars is about 11,500 and 19,000, respectively, and the ratio shows an upward trend with values well above one, between 1.75 and 1.85.Footnote 6

Finally, Fig. 5 shows the evolution of total \({\text {CO}}_{2}\) emissions coming from all final consumers (including electricity) as well as those \({\text {CO}}_{2}\) emissions only coming from passenger cars, which represents, on average, about 15% of total emissions. While both series have decreased for the entire period analyzed, the reduction has been significantly smaller for the passenger cars sector (2% for cars vs. 15% for total emissions). As commented above, however, the existing empirical papers lead to contradictory conclusions about this issue. In order to analyze the correlation between these variables and to characterize whether the fuel taxation is optimal, we rely on predictions from a dynamic general equilibrium (DGE) model, which puts together several of the most important aspects of the cars sector and makes the distinction between diesel motor and gasoline motor vehicles.

3 A dynamic model of car usage and carbon emissions

We build on a neoclassical DGE model with a representative agent and durable goods (cars), distinguishing between diesel and gasoline motor cars. Special attention is given to the services provided by automobiles and the indirect effects that they generate through their use and the consequent \({\text {CO}}_{2}\) emissions. We assume the presence of a government that levies a variety of fiscal tools that affect the decisions to acquire a new car and the amount it is driven. The time subscript is omitted if unessential, with \(V^{\prime } \) denoting the one-period ahead value of the variable V. The diesel attribute is subindexed with \(j=1\) and the gasoline attribute with \(j=2\).

The analysis of car usage (Wei 2013) together with the externality of climate change (Golosov et al. 2014) requires the use of a DGE model for three main reasons. First, climate change is a global externality that motivates the use of analytic general equilibrium tools. Second, \({\text {CO}}_{2}\) emissions linger in the atmosphere with a very high persistency, which damages human welfare in the short and long terms. Thus, we need tools that quantify the cost of current and future damage. Finally, cars are durable goods, and agents take their purchase and usage decisions in a dynamic way.

3.1 Preferences

The economy is inhabited by an infinitely lived, representative household with time-separable preferences in terms of consumption of a final non-durable good, C, direct services provided by cars (a final durable good), S, and hours worked, H. Preferences are represented by a strictly concave utility function,

where \(\beta \in [0,1)\) is the discount factor.

The principal results of this paper only require quasi-concavity of the utility function, and thus, they are not affected by the form of the utility function, as in Golosov et al. (2014).Footnote 7 However, in order to conduct the simulations in Sect. 5, which illustrates (quantitatively) our model and results, we need to assume a specific utility function. We consider the following separable utility function, which is a standard functional form in the DGE literature (Greenwood et al. 1988), adapted to the case of the usage of a car:

where \(\psi _{s}>0\) accounts for the willingness to drive a car; \(\psi _{h}>0 \) represents the (un-)willingness to work; and \(\nu >0\) is the Frisch elasticity of labor.Footnote 8

Let us denote by \(Q_{j}\) and \({\tilde{N}}_{j}\) the stock of vehicles and the kilometers driven in a car of type j, respectively. The services from vehicles powered with fuel \(j=1,2\), \(S_{j}\) depend on the ownership and utilization of the car, i.e., \(S_{j}={\tilde{N}}_{j}^{\varsigma }Q_{j}\), with \( 0<\varsigma <1\) which implies that using cars has diminishing returns; thus, it is better to use cars less intensely and have more cars. Finally, we assume that the vehicle service S is a function of the services provided by vehicles fueled with diesel, \(S_{1}\), and with gasoline, \(S_{2}\), according to a CES function:

where \(\rho \le 1\) denotes the elasticity of substitution between the services of both diesel and gasoline cars, with \(0\le \rho \le 1\) implying a certain degree of substitutability between cars; \(\chi _{j}\in (0,1)\) represents a welfare parameter for the use of diesel and gasoline cars.

The use of the fleet (i.e., driving cars) requires consuming fuel, \( F_{j}=f_{j}{\tilde{N}}_{j}Q_{j}\), and devoting resources to the maintenance and repairs of the car, \(MR_{j}=m_{j}{\tilde{N}}_{j}Q_{j},\) for \(j=1,2\), where \(f_{j}\) denotes the liters of fuel j per kilometer in a car of type j, with \(f_{1}<f_{2}\) (recall that diesel is more efficient than gasoline), and \(m_{j}\) refers to the quantity of maintenance and repair services needed per kilometer.Footnote 9

The stock of cars evolves according to a geometrical law of motion:

with \(X_{j}\) being the flow of new cars purchases and \(\alpha _{j}\in \left( 0,1\right) \) being the geometrical rate of depreciation; thus, \(\alpha _{j}Q_{j}\) can be viewed as total scrapped vehicles.

Finally, total kilometers driven (TKD) in the economy is given by:

3.2 Technology

The supply side of the economy consists of three sectors: a sector producing a final consumable good Y, used as a numeraire in the rest of activities; an automotive industry producing two types of new cars, gasoline and diesel-powered cars, \({\mathcal {X}}_{j}\), \(j=1,2\); and a refinery which produces two fuels, diesel and gasoline, \({\mathcal {F}}_{j}\), \(j=1,2\).

The final consumption good Y is produced according to a Cobb–Douglas production function, which employs physical capital, \(K_{Y}\), and effective hours worked, \({\widetilde{H}}\), under constant returns to scale. The production frontier is affected by the aggregate total factor productivity (TFP) A, which is damaged by the \({\text {CO}}_{2}\) concentrated in the atmosphere, Z, in excess of that of the preindustrial era (581 Gts, according to Golosov et al. 2014):

where \(\gamma >0\) is a damage factor. Moreover, we consider a certain degree of complementarity between cars services (durable consumption), S, and the supply of labor (Fisher 2007), such that the amount of hours measured in efficiency units, \({\widetilde{H}}\), are given by \(H^{\mu }S^{1-\mu }\), with \( \mu \in [0,1]\).Footnote 10 Such a complementarity between vehicle services and hours worked takes into account the idea that cars are not merely durable consumable goods, but that their use also affects productivity and increases hours worked in terms of efficiency units (Fisher 2007).

The automotive industry and the refinery are capital intensive, and, for simplicity, we disregard labor as a productive factor in these sectors. Moreover, we assume that emissions do not cause damage to these sectors (Golosov et al. 2014; Hassler et al. 2016). The representative firm in the automobile sector is assumed to manufacture cars with different engines—diesel and gasoline combustion motors—using only capital, \(K_{X,j}\),

with \(\theta _{x}\in \left[ 0,1\right] \), \(a_{j}>0\), and aggregate TFP affecting this sector as well.

Fuel is produced in a single plant of a refinery which combines crude oil, o, and capital, \(K_{F,j}\), under a constant return to scale technology:

where \(b_{j}>0\) denotes technological parameters in the production of diesel and gasoline, respectively.Footnote 11 Again, aggregate TFP A affects this sector. Crude oil is assumed to be exogenously produced and supplied in a perfectly elastic way at price \(p_{o}\).

Finally, capital K is accumulated according to the following law of motion

where \(\delta \in (0,1)\) is the capital depreciation rate and I denotes gross investment, and the aggregate capital is allocated across the alternative sectors:

3.3 \({\text {CO}}_{2}\) emissions and the carbon cycle

Let E denote the world flow of \({\text {CO}}_{2}\) emissions, represented according to the following structure:

where \(E^\mathrm{cars}\) denotes the emissions due to passenger vehicles in Europe, \( E^\mathrm{other}\) is the flow of European emissions other than those emitted by passenger vehicles, and \(E^\mathrm{RW}\) denotes emissions from the rest of the world. \( E^\mathrm{cars}\) depends on the carbon content of the fuel. After combustion, most of the carbon content is emitted as \({\text {CO}}_{2}\) and, in a minor proportion, as other pollutants (HC or CO). Thus, we can assume that car emissions are a by-product of fuel consumption, \(F_{1}\) and \(F_{2}\) (EPA 2011):

where \(\phi _{j}\) is the \({\text {CO}}_{2}\) content per liter of fuel \(j=1,2\), with \( \phi _{1}/\phi _{2}\) being approximately equal to 1.145 as discussed in Introduction and Sect. 2.

We assume the stock of \({\text {CO}}_{2}\), Z, evolves according to the carbon cycle proposed by Golosov et al. (2014). Using related studies, these authors assume that \(20\%\) (\(\varphi _{L}=0.2\)) of \({\text {CO}}_{2}\) emissions, denoted by \(Z_{1}\), remain in the atmosphere for thousands of years. The remaining fraction (\(1-\varphi _{L}=0.8\)), a percentage \(\varphi _{0}\) has an average life of 300 years in the atmosphere (this part is denoted by \( Z_{2}\)), and a percentage \(1-\varphi _{0}\) is in the surface of the oceans and in the biosphere, with an average of about one decade, denoted by \(Z_{3}\) . \(Z_{1}\), \(Z_{2}\) and \(Z_{3}\) can be represented by a geometrical law of motion with decay factors \(\delta _{1}=0\), \(\delta _{2}\) and \(\delta _{3}\), respectively, with \(\delta _{3}>\delta _{2}>0\). Thus, the aggregate stock Z is governed by the following law of motion:

In subsequent representations, this carbon cycle will be abbreviated to the following state-space form:

3.4 Government and household budget

Let \({\mathbf {p}}\) denote the vector of prices (relative to that of the final good Y) related to a vehicles ownership and use, \({\mathbf {p}}=\left( p_{X1},p_{X2},p_{F1},p_{F2},p_\mathrm{MR}\right) \), where \(p_{Xj}\) denotes the acquisition price of a brand new vehicle j, \(p_{Fj}\) is the fuel j price, and \(P_\mathrm{MR}\) is the real price of one unit of maintenance and repairs services (we assume it is the same for \(j=1\) and \(j=2\)). The three raw inputs in this economy, labor, capital and oil, are traded in competitive markets at prices \(\left( W,R,p_{o}\right) \), denoting wage, rental price of capital, and the real exchange rate (in units of the final consumption good) of crude oil. Real prices \(p_{o}\) and \(p_\mathrm{MR}\) assumed to be exogenous because repair services and the extraction of crude oil are supplied in a perfectly elastic way.

The government uses two types of taxes which influence the agents’ decisions: (i) a taxation \(\left\{ \tau _{X1},\tau _{X2}\right\} \) that affects the price of new vehicles: \(\left( 1+\tau _{Xj}\right) p_{Xj}\); (ii) taxes on fuel \(\left\{ \tau _{F1},\tau _{F2}\right\} \) that affect the operating cost of cars: \(\left( p_{Fj}+\tau _{Fj}\right) \). Tax revenues are fully rebated to the household every period via a lump sum transfer TR. Therefore, the public budget is balanced period by period:

Household budget can be written as:

where \(\Pi \) are profits from the automotive sector in the economy; I denotes individual gross investment in a physical capital asset K; the term \({\overline{mc}}_{j}\) denotes the operating (marginal) cost per kilometer driven \({\tilde{N}}_{j}\), and encompasses expenditures of fuel (including taxes) and maintenance and repair services:Footnote 12

4 Market equilibrium and social planner allocations

To improve the readability of this section, a detailed explanation and derivation of the solutions for both the market equilibrium and the social planner problem, as well as the standard optimal conditions (i.e., the intertemporal allocation for consumption and the static condition for labor), are reported in the technical “Appendixes A and B.”

4.1 Household decisions in a market economy

The representative household in this model maximizes her present value utility (1), subject to the budget constraint (19) and the state equations for capital (9) and vehicles (4), where prices are taken as given. The state of carbon concentration Z (13) and its costs over the production frontier (6) are neglected in the competitive problem. “Appendix A” presents a detailed description of the problem and a definition of the competitive equilibrium. The first-order conditions are as follows:

First is the condition determining the decision to purchase a brand new car of type j:

for \(j=1,2\). This condition is the key to determining the impact of policy variables over the way households replace diesel with gasoline cars and vice versa. It shows that the price of a new car (including taxes) of type j (the lhs) must be equal to the future stream of services (first term in the rhs), minus the operating cost of using cars (second term) and the future stream of possible charges to maintain the car (third term), in terms of the consumption utility that must be forgone.

The second relevant set of conditions determines the usage (kilometers) of cars, \({\tilde{N}}_{j}\):

for \(j=1,2\).. This is a static condition and states that the marginal benefit of driving (lhs) must be equal to its marginal cost (rhs), every period. Notice that, for \(\rho \in (0,1)\) (i.e., assuming diesel and gasoline cars are substitute), any change in the stock of cars \(Q_{j}\) would imply a reduction in \({\tilde{N}}_{j}\), that is, having more cars implies driving the existing cars less intensively.

It is illustrative to show the division of this expression for \(j=1\) and \( j=2 \),

which provides the relative vehicle utilization, \({\tilde{N}}_{1}/{\tilde{N}} _{2} \), dependent on the relative operating costs (inversely) of the two type of vehicles \({\overline{mc}}_{2}/{\overline{mc}}_{1}\), their relative preferences about the services they provide, \(\chi _{1}/\chi _{2}\), and the relative stock \(Q_{2}/Q_{1}\) of cars (inversely). The elasticity of the \( {\tilde{N}}_{1}/{\tilde{N}}_{2}\) ratio with respect to their relative marginal operation costs is given by \(-1/\left( 1-\varsigma \rho \right) \), which is one of the key values for measuring the changes in the fleet and in the kilometers driven.

4.2 Social planner allocations

The solution of the planner problem sets out how to optimally allocate resources over time taking into account how car ownership and usage affects the economy and global pollution. The social cost of carbon (SCC) is also derived, as part of the optimal allocation. Appendix B shows a detailed description of the planner problem and optimal conditions.

We focus below on the optimal conditions related to automobiles (purchase and usage of cars). These conditions distinguish our framework from the related literature that has emerged from Nordhaus and Boyer (2000) and Golosov et al. (2014) in recent years. Throughout this section, we define \(\mathrm{MPK}_{\ell }\) as the marginal product of capital in the production of goods \( \ell \), for \(\ell =Y,X_{1},X_{2},F_{1},F_{2}.\)

The first key condition defines the optimal acquisition of new cars of type j, \(X_{j}\):

for \(j=1,2\). This condition is the counterpart to (21) and means that the current marginal cost of an extra j car in terms of the final consumption goods (the lhs) must be equal to its expected future net benefits (the rhs). The rhs includes the benefits in terms of the flow of services enjoyed by the owner (including the benefit through labor productivity), the cost of driving a j-type car and the social damage of driving cars in terms of global warming.

The second relevant condition defines the optimal decision of driving a j car, \({\tilde{N}}_{j}\):

for \(j=1,2\). This condition is the counterpart to (22) and shows that the marginal social benefit of driving (the lhs) must be equal to its social marginal cost (the rhs), which includes the resources needed to drive 1 km in utility units, and the environmental damage of an extra kilometer travelled with a car of type j.

The last relevant condition sets the expression for the marginal social cost of carbon (SCC) concentration, \(V_{Z}\), which is equivalent to the expressions in Golosov et al. (2014) or Hassler et al. (2016):

with,

for \(n=1,2,3\), noting that \(0=\delta _{1}<\delta _{2}<\delta _{3}<1\), and with the first term \(-\gamma Yu_{C}<0\) denoting the instant marginal damage of an extra carbon molecule emitted in the atmosphere. Iterating forward in time on \(V_{Z}\) provides an alternative manner to interpret this term,

Thus, \(V_{Z_{n},t}\) can be seen as the discounted value of future marginal damages from global warming, with \(\left( 1-\delta _{n}\right) \beta <1\) being the discount factor for each component of carbon concentration, \(Z_{n}\) , for \(n=1,2,3\). The set of expressions in (28), combined with (26), provide the SCC (in present value and utility units) in the economy, which is given by:

4.3 Pigouvian taxation

Comparing the decision of driving in the market equilibrium with its social planner counterpart, (22) versus (25), the Pigouvian tax on fuel j can be written as,

for \(j=1,2\).Footnote 13 This proportion is given by the \({\text {CO}}_{2}\) content per liter of fuel j parameter, \(\phi _{j}\), regardless of the fuel efficiency of the motor car, \(f_{j}\). Thus, the relative Pigouvian tax rate (diesel vs. gasoline) is given by

which is independent of the fuel efficiency ratio, \(f_{1}/f_{2}\).

Recall from the discussion in Introduction that the fact that the \( f_{1}/f_{2}\) ratio is less than one (i.e., diesel cars need fewer liters than gasoline cars to travel the same distance) has been used to argue the benefits of the dieselization policy. Our result points out that the correct policy is independent of this ratio. The fact that \(f_{1}/f_{2}\) is less than one is already internalized by the household in their decisions; thus, the government should not intervene at this point and further incentivize the use of diesel. However, households are not internalizing the amount of \( {\text {CO}}_{2}\) they generate when they consume each type of fuel, which depends on \( \phi _{1}\) and \(\phi _{2}\).

It is illustrative to derive an explicit expression for \(\tau _{F_{j}}^{+}\) from (30) in steady state,

This condition implies that the Pigouvian tax rate increases with the scale of emissions from fossil fuel combustion by cars \(\phi _{j}\), with the residence time of \({\text {CO}}_{2}\) in the atmosphere (the closer to zero \(\delta _{2} \) and \(\delta _{3}\) are), with the damage parameter \(\gamma \), and decreases with the discount rate (the closer to one the \(\beta \) is).

Finally, whenever fuel taxes are fixed according to a Pigouvian criterion and in the absence of other distortions, it is straightforward to obtain that tax on the purchase of vehicles must be zero, i.e., \(\tau _{X1}^{+}=\tau _{X2}^{+}=0\) (see the technical Appendix C for a formal proof). This result implies that sales taxes are not needed to internalize the costs from \({\text {CO}}_{2}\) emissions and that fuel taxes are sufficient to encompass the social damage generated from fuel combustion if they are set in a Pigouvian way. Note, however, that this result does not imply that car purchases should be VAT exempt. Rather, it claims only that a sales tax is inadequate to internalize the external cost of \({\text {CO}}_{2}\) emissions.

5 Quantitative analysis: car usage, dieselization and \({\text {CO}}_{2}\) emissions

In this section, we first calibrate our DGE model for the set of EU countries. Second, we provide a model validation exercise to show whether our simulations are able to reproduce, among other things, key elasticities and dynamics in the car sector in Europe. Third, we quantify the Pigouvian taxation. Finally, we solve the model numerically to quantify the benefits of adopting the Pigouvian allocation (or, from another angle, the cost of being away from the optimal policy).

5.1 Calibration

We summarize the most important aspects of the calibration. To simplify the presentation, we pay special attention to those parameters related to the stock of cars \(\left( Q_{1},Q_{2}\right) ,\) kilometers driven \(\left( {\tilde{N}}_{1},{\tilde{N}}_{2}\right) \), and to the carbon cycle. All parameters are given in Tables 1 and 2.Footnote 14

The model is calibrated for our sample of EU13 countries (Sect. 2). The year 1999 is chosen as the reference period for several reasons. Certain series that distinguish between diesel and gasoline in cars, such as kilometers driven or fuel efficiency, are only available from 1999 onward. Our set of EU13 economies were relatively close to their balanced growth path by this year.Footnote 15 Overall, choosing 1999 as the reference year is a reasonable assumption and the main conclusions of the paper do not heavily depend on it.

Parameters determined ex ante Table 1 presents the list of parameters taken exogenously from the model, together with their data source or reference. This list of parameters include the Frisch elasticity, the labor income share for the final good sector, the fuel prices (plus taxes) and those parameters related to the carbon cycle.

For average prices and taxes, we use \(p_{F_{1}}=0.330\) euros per liter of diesel, \(p_{F_{2}}=0.357\) euros per liter of gasoline, and \(\tau _{F1}=0.812\) euros per liter of diesel versus \(\tau _{F2}=1.111\) euros per liter of gasoline (Weekly Oil Bulletin, European Commission). From the European Automobile Manufacturers Association (ACEA), we take a \(20\%\) sales tax for new cars which is same for both types of vehicles, \(\tau _{X1}=\tau _{X2}=0.20\).

We retrieve series of capital and value added from the EU KLEMS database for our EU sample to calculate an average capital-to-output ratio of 3.56 between 1993 and 2007 (an interval around 1999). This ratio is referenced to set a (yearly) real interest at 4.29%, which implies a subjective discount rate \(\beta \) of 0.990.

The key parameters for measuring the SCC are the discount rate \(\beta \), the damage factor \(\gamma \), those related to the carbon cycle in (17 ), and to the \({\text {CO}}_{2}\) emissions from fuel, \(\left\{ \phi _{j},f_{j}\right\} _{j=1,2}\). From Sect. 2, we described that \(\phi _{1}=2.689\) kg. \({\text {CO}}_{2}\)/l of diesel, and \(\phi _{2}=2.348\) kg. \({\text {CO}}_{2}\)/l of gasoline, with \(\phi _{1}/\phi _{2}=1.1455\). Although these parameters are estimated for the USA (EPA 2011), they are very similar to those reported by Santos (2017) for the EU countries.

The global warming damage parameter \(\gamma \) in the production function ( 6) is set to 2.379 \((\times 10^{-5})\) (IPCC 2007), which means that a concentration of \(Z=802\) Gt. in excess of the preindustrial level 581 Gt. produced a \(0.52\%\) increase in damage on the 1999–2000 global output, i.e., \(1-e^{-\gamma \left( 802-581\right) }=0.0052\). The parameters related to the carbon cycle in (14)–(16) are borrowed from Golosov et al. (2014) and the references therein: \(\varphi _{L}=0.2\) (20% of total emissions remain in the atmosphere forever), \(\left( 1-\delta _{2}\right) ^{4\times 200}=0.5\) (carbon concentration \(Z_{2}\) has an average life of 300 years), \(\delta _{3}=\frac{1}{4\times 10}\) (\(Z_{3}\) has a residence time of one decade following a geometric decay); finally, the percentage \(\varphi _{0}\) is calibrated to ensure that total emissions have an average life of 200 years, 0.5 \(=\)\(\varphi _{L}+\)\(\left( 1-\varphi _{L}\right) \left[ \varphi _{0}\left( 1-\delta _{2}\right) ^{4\times 200}+\left( 1-\varphi _{0}\right) \left( 1-\delta _{3}\right) ^{4\times 200} \right] \), which implies \(\varphi _{0}=0.4557\).

Parameters that require solving the model Table 2 presents the complete list of endogenous parameters and targets (i.e., statistical moments and other references). We use the steady-state first-order conditions and the state equations as a system of equations whose solution meets the targeted moments given in Table 2, given the parameters in Tables 1 and 2. The main moments required in our calibration are the following: gross investment accounts for \(20\%\) of the EU13 GDP; the labor income share (Table 1, EU KLEMS) is 0.658; the diesel to gasoline of vehicle ratio, \(Q_{1}/Q_{2}\), is 0.188; the diesel to gasoline fuel consumption ratio, \(F_{1}/F_{2}\), is 0.331; the fuel efficiency ratio \( f_{1}/f_{2}\) is 0.877; and the relative mileage is \({\tilde{N}}_{1}/{\tilde{N}} _{2}=1.63\) (i.e., diesel motor cars are driven \(63\%\) more than gasoline cars).Footnote 16

Given the calibrated value of the parameter \(\varsigma =0.6\), we propose a value for \(\rho =0.15\), which entails a certain degree of substitution between gasoline and diesel vehicles (when \(\rho \) is in the interval (0; 1], diesel and gasoline cars are substitute). According to these parameters, the elasticity of substitution of the mileage with respect to the relative operating costs is \(-1/\left( 1-\varsigma \rho \right) =-1.10\). This elasticity is key to predict changes in \(Q_{1}/Q_{2}\), \({\tilde{N}}_{1}/{\tilde{N}}_{2}\) and TKD, according to equation (23).

5.2 Model elasticities

We next provide a set of simulation exercises to validate model predictions. We focus on the average behavior of our set of EU13 countries between 1999 and 2015, as described in Sect. 2. Our benchmark calibration is taken to reproduce the situation at the beginning of the sample (1999 in our case).

First, we show that the model produces elasticities similar to those estimated by the empirical literature. Table 3 presents a summary of elasticities given by Goodwin et al. (2004). The short-run price elasticity of fuel demand is \(-\,0.25\) (averaged over 46 studies), ranging between \(-\,0.57\) and \(-\,0.01\). For the long term, this elasticity is \(-0.64\) (averaged over 51 studies), and ranges between \(-\,1.81\) and 0. Kilometer driven (both total and individual per vehicle) is usually more inelastic than fuel demand by factor of 1.5–2.0.Footnote 17 These estimates do not differentiate between diesel and gasoline.

For our benchmark calibration, Table 4 presents model elasticities of fuel demand. Given that the model does not produce isoelastic behaviors, we provide a range of values for several changes in both fuel prices and fuel efficiencies. To implement exogenous changes in fuel prices, we impose a permanent change in fuel taxation (ceteris paribus) and quantify the implied change in key endogenous variables: fuel demanded, kilometers driven and vehicle stock. We also analyze the effect of a permanent change for the relative fuel efficiency (diesel relative to gasoline, \(f_{1}/f_{2}\) in our notation). The first column in Table 4 reports elasticities with respect to the diesel fuel price. The own-price elasticity of diesel demand ranges between \(-0.69\) and \(-0.79\), which meets the surveyed values of Goodwin et al. (2004). Analogously, the cross-price elasticity of gasoline demand (i.e., w.r.t. the price of diesel) is positive but low, due to a long-run substitution effect. Traffic elasticities are lower than fuel demand elasticities, though not by the factor of 1.5–2.0 highlighted by Goodwin et al. (2004).

When we consider permanent changes in the relative fuel efficiency, the responses are always inelastic (i.e., their absolute values never exceed unity). In response to a one percent permanent increase in the relative fuel efficiency (lower diesel liters per km), kilometers driven by diesel vehicles increase between 0.78 and 0.92% (kilometers driven by gasoline vehicles change by \(-0.06\%\)), the stock of diesel cars increases by 0.018% (the stock of gasoline motor vehicles change by \(-0.03\%\)), and the demand of both types of fuel decreases (between 0.21 and 0.25% of diesel and about 0.06% of gasoline). Consistent with our simulations, Frondel and Vance (2018) report evidence for Germany that distance traveled is less elastic with respect to prices (\(-0.39\)) than to fuel efficiency (0.67).

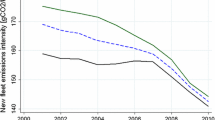

As a second numerical exercise, we simulate the market equilibrium taking the average fuel taxes for our set of EU13 countries between 2000 and 2015 as exogenous (those shown in Fig. 3), and assuming that all other parameters are constant (the state of productivity, preferences, other taxes, etc.).Footnote 18 Figure 6 represents the simulated trajectories for relative vehicle stock, kilometers driven and fuel consumption (diesel to gasoline). For comparative purposes, we also include the observed series of these three ratios between 2000 and 2015.

The simulated series for the diesel to gasoline cars ratio and the relative fuel consumption (first and third subplots, respectively) widely differ from the reported observed series. Thus, we can conclude that the dieselization process (i.e., the replacement of gasoline vehicles by diesel vehicles) cannot be justified on the grounds of the existing fuel taxation policies favoring the use of diesel fuel. While the relative diesel to gasoline taxation has remained quite stable from 2000 to 2015, the share of diesel cars has increased from 19 to 42%. The small simulated elasticities (last row in Table 4), which are consistent with empirical estimates, already pointed out to this fact.

The second subplot in Fig. 6 represents the diesel to gasoline relative mileage. According with our simulations, the higher mileage of diesel vehicles is consistent with the existing fuel taxation differences between diesel and gasoline. In this case, taking fuel taxes for granted and holding constant the rest of structural elements, the diesel to gasoline mileage ratio is always higher than one and close to the observed levels (ranging between 1.6 and 1.7) in the 2000–2015 period. Moreover, the model reproduces part of the observed dynamics.

Finally, by comparing the three subplots, we can also conclude that the increase in the relative fuel demand is associated with the steady increase in the relative stock of diesel cars rather than with the trajectory of the relative kilometers driven.

5.3 Model validation

We next analyze whether our DGE model can reproduce the dieselization process which took place in Europe between 1999 and 2015 in response to changes in certain fundamentals. Results are shown in Table 5. More specifically, we try to explain the increase in the share of diesel vehicles from 18 to 42%, an increase in the relative fuel consumption (diesel/gasoline liters) from 0.33 to 1.10 and a relative mileage of 1.81. (These three targets are presented in the last column of Table 5.)

To this purpose, we consider the following five structural forces of change: fuel taxes, new vehicle sale taxes, fuel efficiency, preferences and productivity.

We calculate the equilibrium values by incorporating these five sources of change sequentially. Columns (a)–(c) incorporate changes of fuel taxes, sale taxes and fuel efficiency, respectively. These factors are exogenously determined. Fuel taxes are changed from the average observed levels in 2000 (\(\tau _{F1}=0.49\) and \(\tau _{F2}=0.66)\) to the average observed levels in 2015 (\(\tau _{F1}=0.71\) and \(\tau _{F2}=0.89)\). Notice that diesel taxation is more lenient than gasoline in all years (recall from Fig. 3). As the second source, we consider a permanent reduction in the tax rate levying the purchase price of diesel cars from \(\tau _{X1}=0.2\) (benchmark case) to \( \tau _{X1}=0\). To justify this case, apart from the arguments provided in Miravete et al. (2018),Footnote 19 we consider all possible circumstances that have incentivized the purchase of diesel cars in Europe during the last decades, such as a VAT rate reduction, tax rebates to diesel car buyers, lower registration fees or the benefits in ownership cost per year (once the vehicle has been purchased).Footnote 20 As the third channel, we assume fuel efficiency changes between 2000 and 2015 as measure in the data (Fig. 2): \(f_{1}/f_{2}\) changes from 0.88 to 0.85.

We first notice that these exogenous factors (columns a, b, c) add little to explain the dieselization of the vehicle fleet. These three changes together (accrued in column c) would predict a 2 p.p. in the variation of the diesel car share from 0.19 to 0.21, and a decrease in the relative mileage from 1.63 to 1.48. Thus, the remaining fraction should be accounted by other factors.

In our exercise, we consider in columns (d) and (e) changes in relative preferences and productivity, \(\chi _{1}/\chi _{2}\) and \(a_{1}/a_{2}\), respectively. Since we cannot observe these changes in the data, we choose values in \(\chi _{1}/\chi _{2}\) and \(a_{1}/a_{2}\) in order to target the following observed ratios in 2015: \(F_{1}/F_{2}=1.10\) (relative fuel), \( Q_{1}/(Q_{1}+Q_{2})=0.42\) (relative cars stock) and \({\tilde{N}}_{1}/{\tilde{N}} _{2}=1.81\) (relative mileage).

Thus, our fourth driver is related to a change in preferences, where consumer preferred vehicles with greater fuel economy and other diesel vehicle improvements, such as design or speed. In this sense, Miravete et al. (2018) provide evidence of European policies that “served to protect domestic European manufacturers by fostering a preference for diesel cars mainly produced by European automakers.” In terms of our model, this change can be motivated by increasing the ratio \(\chi _{1}/\chi _{2}\) in the household utility function (3) to target the increase in the relative fuel consumption from \(F_{1}/F_{2}=0.33\) to 1.10 (under the benchmark case, the ratio of these parameters is \(\chi _{1}/\chi _{2}=0.36\)). Under this case (column d), which adds to the scenario in column (c), the share of diesel cars increases to 37% (a 18 p.p. increase), although the relative mileage overreacts to 2.20. (The observed relative mileage is 1.81 in 2015, as shown in Fig. 4.)

Finally, our fifth channel (changes in relative productivity) can be interpreted as a wedge that fosters the \(a_{1}/a_{2}\) ratio in equation (7). This increase is also motivated by Miravete et al. (2018), which also argue that the European auto industry has developed and specialized in the diesel technology. As long as this factor is also not observable, as for the relative preference, we pursue to set \(a_{1}/a_{2}\) to target the increase in the diesel stock share from 19% to 42% (the benchmark case corresponds to \(a_{1}/a_{2}=0.5\)). Under this case (column e), which adds to the scenario in column (d), the relative fuel consumption and the relative mileage meet reasonably well the target values in 2015.

Summing up, when changes in observable exogenous variables are incorporated in the model (column c), the model predicts small changes (2 p.p., around 8%) in the stock of diesel cars: (21–19)/(42–19). By contrast, adding the changes in the preferences to target the relative fuel consumption (column d) accounts for an extra of 71 p.p. The remaining (unobservable) change presented in column (e) for the sectorial productivity would account for the remaining 21 p.p. in the variation of the diesel car stock.

5.4 Pigouvian taxes

We use condition (32) to estimate the Pigouvian tax rate per liter of diesel and gasoline implied in our model economy. In order to compare our results with those in Nordhaus (2008), Golosov et al. (2014) or Hassler et al. (2016), we use the same scaling for the output level Y in (32) and show results in Euros and US$ (1999 levels) per liter of diesel and gasoline and their equivalence in terms of tons of Carbon.Footnote 21 As we will show, our results are in line with those given by the related literature.

Table 6 shows the Pigouvian tax levels for a number of alternative discount factors. We use the carbon factors proposed by EPA (2011) for the USA, which meet those given by Santos (2017) for European countries. Our benchmark case (column (ii)) assumes a real interest rate of \(4.29\%\), implying a Pigouvian tax rates of 1.83 Euro cents per liter of diesel and 1.60 Euro cents per liter of gasoline. In terms of Euros per ton of Carbon, these rates are equivalent to paying 26.6 US$ or 25.0 Euros.Footnote 22 It is relevant to compare this result with that of Parry and Small (2005) because, although their setting is different, they consider a model for car usage and quantify the social cost of using gasoline that includes other carbon externalities: global warming, pollution, crashes and road congestion. Our estimated 1.60 Euro cents per liter for gasoline is equivalent to 6.4 US$ cents per gallon, which basically meets the rate obtained by Parry and Small (2005) to internalize the costs of climate change, i.e., 27 US$ per ton of Carbon (see also Fullerton and West 2002; Thomas and Joshua 2013).

Alternatively, we consider an upper bound for a 5% interest rate (column (i)), where the resultant capital–output ratio meets that of the US economy (around 3.0), and an intermediate scenario with a 3% interest rate (column (iii)) often used in a Neoclassical framework. In these two cases, we obtain levels of tax rates of about 1.62 Euro cents for diesel and 1.41 Euro cents for gasoline, which are equivalent to 23.5 US$ per ton of Carbon.

In general, these levels are similar to those given by Nordhaus and Boyer (2000), but lower than the ones estimated by Golosov et al. (2014) or Santos (2017), who reported a level of 57 US$ (54 Euros) and 103 US$ (97 Euros), respectively. In light of Table 6, this different result depends on the discount factors considered. Thus, if we consider the same discount factor as the one in Golosov et al. (2014) (1.5%, column (iv)), we obtain Pigouvian diesel tax rates of 4.40 Euros cents per liter for diesel and 3.84 Euros cents per liter for gasoline, which is equivalent to 63.9 US$ per ton of Carbon, similar to the value obtained by the authors. Finally, for a real interest rate of \(0.1\%\) (5th column, as in Stern 2007), the Pigouvian taxes are 36.07 and 31.49 Euros cents per liter for diesel and gasoline, respectively, which is equivalent to 523.9 US$ per ton of Carbon, and close to the 496 US$ obtained by Golosov et al. (2014) under this scenario.Footnote 23 Thus, in terms of quantifying the cost of Carbon, we conclude that our quantitative results are in line with those given by the related literature.

To conclude this analysis, one further comment is in order. Although estimated levels are different for the alternative scenarios, the ratios \( \tau _{F1}^{+}/\tau _{F2}^{+}\) are all equal to \(\phi _{1}/\phi _{2}=1.145\) (consistent with (31): the Pigouvian fuel tax ratio must be \(14.5\%\) higher for diesel than for gasoline). As stated in Sect. 2 and looking at the Oil Bulletin of the European Commission, the fuel tax ratio (Euros per liter of fuel) \(\tau _{F1}/\tau _{F2}\) has been smaller than those in most EU countries during the analyzed period, averaging 0.767. Only in the UK did that ratio approach 1.0. Moreover, as emphasized by Knittel (2012), most OECD countries follow a similar practice, with Switzerland and the USA being two exceptions, where the tax rate on gasoline is lower.Footnote 24 As in the UK, Australia taxes both fuels equally. It is worth mentioning that Sweden is also heading in the right direction since, although its \(\tau _{F1}/\tau _{F2}\) ratio is smaller than one, its government introduced a tax on \({\text {CO}}_{{\mathbf {2}}}\) emissions in 1991, which is now about 1100 SEK (112.52 Euros) per ton of \({\text {CO}}_{2}\), equivalent to 2.62 SEK (0.268 Euros) per liter of gasoline and 3.24 SEK (0.331 Euros) per liter of diesel.

5.5 Dieselization, fuel consumption and \({\text {CO}}_{2}\) emissions

Since our model economy does not consider other forms of externalities (pollution, crashes or road congestion), the levels of the Pigouvian taxes and the tax rates observed for Europe are not comparable. Thus, the analysis performed so far cannot be used to quantify the cost for Europe of not implementing the Pigouvian policy. To provide a proxy of this quantification, this section lays out the findings of an alternative exercise.

We compare the performance of the following three scenarios: (a) the benchmark economy, which corresponds with the calibrated economy for Europe in 1999, setting \(\tau _{X1}=\tau _{X2}=0.20\) and \(\tau _{F1}=0.812\), \(\tau _{F2}=1.111\), with \(\tau _{F1}/\tau _{F2}=0.73\); an intermediate case (b) where, in addition to the fuel taxation in (a), we impose a sale tax \(\tau _{X1}=\tau _{X2}=0\); and (c) the Pigouvian case, which sets \(\tau _{X1}=\tau _{X2}=0\) and \(\tau _{F1}=\frac{\phi _{1}}{\phi _{2}}\tau _{F2}=\left( 1.145\right) \tau _{F2}\), from condition (32). We retune the levels for \(\tau _{F1}\) and \(\tau _{F2}\) to match the fuel tax revenues raised under the (b) scenario (i.e., cases (b) and (c) produce the same fuel tax revenues). The resultant levels are \(\tau _{F1}^{+}=1.166\) and \(\tau _{F2}^{+}=1.018\). These levels contrast with those reported in Sect. 5.4, when we quantified Pigouvian taxes to be a few cents in both cases, 1.83 and 1.60. For our set of countries, considering all types of external costs (carbon, pollution, noise, congestion and crashes), Santos (2017) has estimated that the costs are 1.55€ and 1.88€ per liter of gasoline and diesel, respectively (average over EU countries). That is, the total costs are 100 times higher than our Pigouvian fuel taxes, limited to the cost of \({\text {CO}}_{2}\). According to Santos (2017), as long as \({\text {CO}}_{2}\) emissions would only account for 4% of the total cost per liter of fuel, the order of magnitude of our Pigouvian taxes is reasonable. Hence, our magnitudes of \( \tau _{F1}^{+}=1.166\) € and \(\tau _{F2}^{+}=1.018\) € in the current exercise should be viewed as though we were accounting for all type of externalities in the model. It is worth mentioning that a Pigouvian taxation that internalizes all other externalities would make the fuel tax much larger than the existing tax levels, according to empirical estimates.Footnote 25

Using the steady-state equilibria, Table 7 presents the percentage deviations for the key model variables under cases (b) and (c) relative to the benchmark scenario (a). First, the Pigouvian-based economy (column c) is more favorable than the benchmark setting in terms of traffic density, \({\text {CO}}_{2}\) emissions and welfare. The vehicle stock adjusts itself accordingly to the new taxation, and the usage of the vehicle fleet readapts itself, thus internalizing the social cost of carbon. The relative mileage rebounds toward gasoline (24.7%), while still reducing the mileage of both types of vehicles. Under the Pigouvian scenario, diesel consumption decreases by 23.5% and gasoline increases by 4.5%. The present value (PV) utility increases by 1.3% under the Pigouvian setting: the lower utility from more hours worked is compensated by an increase in consumption and the flow of services from vehicles. Second, an important fraction in this simulated adjustment has been motivated by the elimination of the sale tax (VAT, column b). The effect of the sale tax removal is crucial for \({\text {CO}}_{2}\) emissions, decreasing by 1.8%, where the replacement effect is dominated by the mileage effect: although the stock vehicles increases by 14.9 and 14.7 percent, respectively, TKD decreases by 14.6 and 14.4 percent.

To conclude our analysis, the lower panel of Table 7 presents a decomposition of vehicle \({\text {CO}}_{2}\) emissions growth into two potential opposite effects: an intensive margin and an efficiency effect (see “Appendix D” for further details). The intensive margin indicates the contribution of a change in traffic density (TKD) to \({\text {CO}}_{2}\) vehicle emissions. The efficiency effect, by contrast, measures how the growth rate of emissions moves in response to a reallocation between vehicles (from gasoline to a more fuel efficient diesel car), given a fixed amount of kilometers driven. As we may see in Table 7, the flow of \({\text {CO}}_{2}\) emissions declines by 1.8% under the intermediate case (b) (due to the removal of the sale tax), and by 2.4% under the Pigouvian scenario (c). Traffic density (i.e., intensive margin) falls by 1.8% and 2.7%, respectively. In both cases, the efficiency effect accounts for a mild fraction of \({\text {CO}}_{2}\) emissions. In this sense, the argument that dieselization could foster energy saving and emission reduction has little support. We can conclude that the intensive margin implied by the dieselization policy would account for the bulk of the change in \({\text {CO}}_{2}\) emissions from automobiles.

6 Conclusions

Tax policies have been favouring diesel over gasoline for the last few decades in most European countries. This action has been justified on the grounds of energy saving and reducing oil dependence. This paper provides theoretical evidence that contradicts the initial beliefs of European countries: dieselization did not help to reduce fuel consumption or \({\text {CO}}_{2}\) emissions of passenger cars, and it is not optimal. In spite of the positive effect of using a more efficient diesel motor car, the replacement of vehicles generates an induced (and indirect) effect on kilometers traveled because of the more intensive use of diesel cars. Our findings suggest that this indirect effect overrides the benefits of using more efficient diesel cars. As a consequence, dieselization has generated a negative impact on total \({\text {CO}}_{2}\) emissions in the sector.

We calibrate the economy for 13 EU countries and solve the transitional dynamics numerically. We show that our model reproduces demand elasticities estimated in the related literature. In a numerical validation exercise, we find that nearly seventy percent of the dieselization should be associated with a change in consumer preferences, about twenty percent to productivity improvements, and only the remaining fraction to policy decisions affecting the sale price of new vehicles. Thus, while fuel taxation cannot explain the dieselization process, it can help explain the rebound (indirect) impact on total kilometers driven and fuel consumption in Europe.

A second finding in this paper indicates that the design of these tax practices has been flawed and lacks consistent public finance grounds. A socially optimal taxation must correct all negative externalities coming from ownership and use of automobiles, such as pollution, congestion, noise and road accidents (Parry et al. 2007). As long as these externalities depend exclusively on the use of cars, optimal taxation should focus on those tax instruments affecting the operating costs of automobiles (through fuel consumption or, instead, through kilometers driven), but not on the purchase of new automobiles. Moreover, balancing for congestion, noise and accidents does not serve to justify a distinct tax favorable treatment of diesel with respect to gasoline.

We argue that global warming via \({\text {CO}}_{2}\) emissions from cars justifies a different tax treatment between diesel and gasoline cars. Focusing on \( {\text {CO}}_{2} \) emissions, the optimal fuel tax ratio is independent on fuel efficiency (in terms of liters per km) and it should be set according to the carbon content of each fuel, which is about 14.5% higher for diesel fuel with respect to gasoline: 1.83 Euros cents per liter of diesel and 1.60 cents per liter of gasoline. This is equivalent to imposing a tax of 25 Euros per ton of carbon, which is comparable with other studies. This result also challenges the Pareto improvement underlying the fuel tax policies implemented by most OECD countries in the last decades, where a policy decisions favoring the dieselization have been common throughout Europe.

Using the DGE model, when comparing the current European policy (i.e., dieselization policy) to a hypothetical Pigouvian setting, we conclude that traffic density could have been reduced by 2.7% and \({\text {CO}}_{2}\) emissions by 2.4%, also implying welfare gains. Finally, when the alternative taxation scenarios have been simulated under alternative preferences, we find that the change in \({\text {CO}}_{2}\) emissions from vehicles is overwhelmingly dominated by the induced increase in traffic density, with the fuel efficiency effect having only a minor ancillary impact.

Notes

Additionally, most economic decisions are dynamic and entail labor productivity changes, which in turn affect firms’ decisions to hire labor and capital and affect prices in other markets. For all that, we need for a DGE model for our analysis.

Santos (2017) also estimates the external cost of gasoline and diesel vehicles accrued over all types of externalities. Road congestion and accidents account for the bulk of these costs per liter of both fuels (82% for diesel and 87% for gasoline), while \({\text {CO}}_{2}\) emissions have a minor role, about 4% in both cases. For local pollution, diesel is more than twice costlier than gasoline, both in terms of kilometer driven or per liter of fuel. In relative terms, a liter of diesel is on average 21% costlier than a liter of gasoline.

This taxation practice is common among OECD countries (Knittel 2012). Two exceptions are Switzerland and the USA, where the tax rate on gasoline is lower. In Australia and the UK, both fuels are equally taxed.

Due to a lack of available data, Fig. 4 is constructed using data from a reduced number of countries: Austria, Denmark, France, Germany, Ireland, Netherlands, Portugal and Spain. Verboven (2002) reports similar figures for France, Belgium and Italy. See Small and Van Dender (2007) for a discussion about these data.

Appendixes A and B, which show the detailed solutions of the competitive equilibrium and the central planner problem, respectively, are formulated using a generic utility function.

Indeed, this type of utility function is in response to Greenwood et al. (1988) preferences. It is Gorman type, so it possesses clear advantages for aggregation purposes. This type of utility function fairly describes the macroeconomic impact of technology that affects the productivity of new capital goods.

The parameters \(\left\{ f_{j},m_{j}\right\} \) are assumed to be exogenous, though they can be affected by technology. For instance, improvements in energy efficiency reduce \(f_{j}\) or a quality improvement in cars may reduce \(m_{j}\). Aghion et al. (2016) show evidence that the automotive industry tends to innovate relatively more in fuel efficiency under tax-adjusted fuel prices increases. The Volkswagen scandal has highlighted that many auto makers have been cheating on the fuel efficiency measurements. This appears to have become more prevalent as more and more governments started to use fuel efficiency as a basis for giving green subsidies for diesel cars. Local pollutants standards have been much more restrictive in the USA than in Europe, as highlighted by Miravete et al. (2018). For the USA, Parry et al. (2007) indicate: “..., since the 1970 Clean Air Act, new passenger vehicles have been subject to grams-per-mile standards for CO, NOx and HC. Initially, these standards were slightly more stringent for cars than for light trucks [...], though standards have been harmonized since the mid-1990s, so it will no longer be the case that light trucks produce more emissions per mile than cars.”

Standard RBC models assume \(\mu =1\), implying that effective hours worked equal hours devoted to non-leisure activities. However, this case makes consumption of durables decrease in response to a positive TFP shock, a prediction not supported by the data. Assuming, instead, that \(\mu <1\) helps the standard model to reconcile with the data (Fisher 2007). Alternatively, one can assume that car services complement non-durable consumption and make the utility function non-separable.

The production of fuel in refinery plants or the production of cars in the auto industry is essentially capital-intense. Including labor in the production function (8) would only add analytical complication with little predictive capacity. The only implication is that the system of general equilibrium equations would require moving hours worked from the rest of sectors to the refinery.

Other costs, such as car insurances and tolls, are fixed costs per vehicle regardless of the number of kilometers driven. These costs can be seen as a negative transfer to the household; thus, we do not include them.

A more formal derivation of this result is provided in the technical “Appendix C.” Fullerton and West (2002), Parry and Small (2005), Nordhaus (2008) or Parry et al. (2014), do similar exercises for similar purposes, though they focus on other externalities, such as congestions, local pollution or accidents.

An extensive technical Appendix about the calibration is available at: https://www.upo.es/econ/rodriguez/index_archivos/Diesel/Appendix_A.pdf.

The average GDP growth rate was 2.4% for 1995–2007 (just before the Great Depression), while it is 1.5% when one includes the years up to 2014, i.e., 1995–2014. The growth rate was 2.3% in 1999, which is in line with the average growth before the Great Depression. Moreover, at world wide level, Hassler et al. (2016) use 2000 as the reference year to set the initial level of carbon concentration.

As commented in Sect. 2, data for kilometers driven should be used cautiously. This ratio is rather low compared to that reported in Sect. 2 for 1999, which was 1.73. However, \({\tilde{N}}_{1}/{\tilde{N}}_{2}=1.63\) is a reasonable assumption. For Belgium, France and Italy, Verboven (2002) reports ratios varying with the weight of the vehicle (1.65 on average). The Encuesta de Hogares y Medio Ambiente by the Spanish National Institute of Statistics (INE 2008) reports an estimate of mileage per diesel car that exceeds that of gasoline cars by 40%. When taking into account the family size, the ratio goes from 60% for single households to 32% for families with 4 or more members.

More recently, Brons et al. (2008) estimated similar values in a meta-analysis. They found long-run values for the price elasticities of (gasoline) fuel demand, kilometers driven and vehicle stock of \(-\,0.864\), \(-\,0.493\) and \(-\,0.08\), respectively.

We eliminate 1998–1999 to avoid a drastic fall in fuel taxation occurred in European countries in these 2 years.

Miravete et al. (2018) emphasize that the more lenient \(\mathrm{NO}_{x}\) emissions standards adopted by European regulators have reduced the sale prices of diesel vehicles and hence have incentive their purchase. A stricter \(\mathrm{NO}_{x}\) emissions policy would have entailed higher marginal cost for the European auto makers, which were specialized in the production of diesel cars. These costs would have implied higher sale prices and led some consumers to substitute diesel cars by gasoline cars.

In this sense, despite most EU countries are using similar instruments, they apply them differently. Mandell (2009) discusses several Swedish policies, mostly reducing the purchase price of new cars, aimed at achieving a more efficient vehicle fleet. For instance, the purchase of an “environment-friendly” car is subsidized by 1000 Euros (10.000 SEK). In most countries, scrapping vehicles that fulfilled certain requirements (related to car age, \({\text {CO}}_{2}\) emissions or pollutants), entitled the owner of the vehicle to a grant to buy a brand new one.

Global output is taken as 70 trillion dollars across a decade. We use an exchange rate of 0.9387 Euros per US$, its average level in 1999.

The atomic mass of carbon is 12, while the atomic mass of the \({\text {CO}}_{2}\) is 44. To convert from tons of \({\text {CO}}_{2}\) to tons of carbon, one should multiply by 12/44.

In the case of a real interest rate of 1.5 or 0.1%, our model produces implausible capital-to-output ratios of 10 and 150, respectively, and for that reason, our preferred case is 4.29%.

From the American Petroleum Institute for 2014, we obtain data for the US ratio \(\tau _{F_{1}}/\tau _{F_{2}}\) by geographical areas. This ratio is always above 1, averaging 1.127.

For example, in terms of 2010 Euros, Santos (2017) estimates for Spain that the external costs of vehicles are 137.63 and 174.83 cents per liter of gasoline and diesel, respectively. As of September 2019, the actual fuel taxes were 69.91 and 58.89 cents per liter of gasoline and diesel, while their respective prices (including taxes) were 130.04 for gasoline and 120.9 cents for diesel. In other words, taking for granted Santos’ (2017) costs, if taxation accounted for the rest of externalities, the final prices would be 198.1 cents per liter of gasoline and 236.8 cents for diesel, which would entail price increases of 52% for the gasoline fuel and 95% for the diesel fuel.

References

Aghion P, Dechezleprêtre A, Hémous D, Martin R, Van Reenen (2016) Carbon taxes path dependency, and directed technical change: evidence from the auto industry. J Polit Econ 124(1):1–51

Brons M, Nijkamp P, Pels E, Rietveld P (2008) A meta-analysis of the price elasticity of gasoline demand. A SUR approach. Energy Econ 30:2105–2122

Chetty R, Guren A, Manoli D, Weber A (2011) Are micro and macro labor supply elasticities consistent? A review of evidence on the intensive and extensive margins. Am Econ Rev 101(3):471–475

De Borger B, Mayeres I (2007) Optimal taxation of car ownership, car use and public transport: insights derived from a discrete choice numerical optimization model. Eur Econ Rev 51:1177–1204

Environmental Protection Agency (EPA) (2011) Greenhouse gas emissions from a typical passenger vehicle. http://www.epa.gov/otaq/climate/documents/420f14040a.pdf

Fisher JDM (2007) Why does household investment lead business investment over the business cycle? J Polit Econ 115(1):141–168

Frondel M, Vance C (2018) Drivers’ response to fuel taxes and efficiency standards: evidence from Germany. Transportation 45:989–1001

Fullerton D, West SE (2002) Can taxes on cars and on gasoline mimic an unavailable tax on emissions? J Environ Econ Manag 43:135–157

Gillingham K, Rapson D, Wagner G (2015) The rebound effect and energy efficiency policy. Rev Environ Econ Policy 1–22

Greening LA, Greene DL, Difiglio C (2000) Energy efficiency and consumption–the rebound effect–A survey. Energy Policy 28:389–401

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82(1):41–88

González RM, Marrero G (2012) The effect of dieselization in passenger cars emissions for Spanish regions: 1998–2006. Energy Policy 51:213–222

González RM, Marrero G, Rodríguez-López J, Marrero A (2019) Analyzing \({\rm CO}_2\) emissions from passenger cars in Europe: a dynamic panel data approach. Energy Policy 129:1271–1281

Greenwood J, Hercowitz Z, Huffman GW (1988) Investment, capacity utilization, and the real business cycle. Am Econ Rev 78(3):402–17

Goodwin P, Dargay J, Hanly M (2004) Elasticities of road traffic and fuel consumption with respect to price and income: a review. Transp Rev 24(3):275–292

Hassler J, Krusell P, Smith AA Jr (2016) Environmental macroeconomics. Chapter 24 in Handbook of macroeconomics, vol 2. Elsevier, pp 1893–2008

Heathcote J, Storesletten K, Violante G (2010) The macroeconomic implications of rising wage inequality in the United States. J Political Econ 118:681–722

Intergovernmental Panel on Climate Change (IPCC) (2007) Guidelines for national greenhouse gas inventories. Energy 2

Jeong SJ, Kim KS, Park J (2009) \({\rm CO}_2\) emissions change from the sales authorization of diesel passenger cars: Korean case study. Energy Policy 37:2630–2638

Knittel CR (2012) Reducing petroleum consumption from transportation. J Econ Perspect 26(1):93–118

Mandell S (2009) Policies towards a more efficient car fleet. Energy Policy 37:5184–5191

Marques AC, Fuinhas JA, Gonçalves BM (2012) Dieselization and road transport \({\rm CO}_2\) emissions: evidence from Europe. Low Carbon Econ 3:54–62

Mendiluce M, Schipper L (2011) Trends in passenger transport and freight energy use in Spain. Energy Policy 39:6466–6475

Miravete E, Moral-Rincón MJ, Thurk J (2018) Fuel taxation, emissions policy, and competitive advantage in the diffusion of European diesel automobiles. RAND J Econ 49(3):504–540

Nordhaus W (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven and London

Nordhaus WD, Boyer J (2000) Warming the World: economic modeling of global warming. MIT Press, Cambridge

Parry IWH, Small KA (2005) Does Britain or the United States have the right gasoline tax? Am Econ Rev 95(4):1276–1289

Parry IWH, Walls M, Harrington W (2007) Automobile externalities and policies. J Econ Lit 45(2):373–399

Rietveld P, Van Woudenber S (2005) Why fuel prices differ. Energy Econ 27:79–92

Rodríguez-López J, Marrero GA, Gonzá lez-Marrero RM (2015) Dieselization, \({\rm CO}_2\) emissions and fuel taxes in Europe, Working Papers 15.11, Universidad Pablo de Olavide, Department of Economics

Santos G (2017) Road fuel taxes in Europe: do they internalize road transport externalities? Transp Policy 53(2017):120–134

Schipper L, Marie-Lilliu C, Fulton L (2002) Diesels in Europe. Analysis of characteristics, usage patterns, energy savings and \({\rm CO}_2\) emission implications. J Transp Econ Policy 36(2):305–340

Schipper L (2011) Automobile fuel, economy and \({\rm CO}_2\) emissions in industrialized countries: encouraging trends through 2008? Transp Policy 18(2):358–372

Schipper L, Fulton L (2013) Dazzled by diesel? The impact on carbon dioxide emissions of the shift to diesels in Europe through 2009. Energy Policy 54:3–10

Small KA, Van Dender K (2007) Fuel efficiency and motor vehicle travel: the declining rebound effect. Energy J 28(1):25–51

Stern N (2007) The economics of climate change: the stern review. Cambridge University Press, Cambridge, UK

Sullivan JL, Baker RE, Boyer BA, Hammerle RH, Kenney TE, Muniz L, Wallington TJ (2004) \({\rm CO}_2\) emission benefit of diesel (versus gasoline) powered vehicles. Environ Sci Technol 38:3217–3223

Thomas K, Joshua L (2013) Fuel prices and new vehicle fuel economy–Comparing the United States and Western Europe. J Environ Econ Manag 66:280–300

Verboven F (2002) Quality-based price discrimination and tax incidence: evidence from gasoline and diesel cars. Rand J Econ 33(2):275–297

Wei C (2013) A dynamic general equilibrium model of driving, gasoline use and vehicle fuel efficiency. Rev Econ Dyn 16:650–667

Zachariadis T (2006) On the baseline evolution of automobile fuel economy in Europe. Energy Policy 34:1773–1785

Zervas E (2010) Analysis of the \({\rm CO}_2\) emissions and of the other characteristics of the European market of new passenger cars. 1. Analysis of general data and analysis per country. Energy Policy 38(10):5413–5425

Acknowledgements

Funding was provided by MINECO (Grant No. ECO2016-76818) and Consejería de Economía, Innovación, Ciencia y Empleo, Junta de Andalucía (Grant No. SEJ-1512).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A The solution of the market equilibrium

We next characterize market equilibrium allocations in terms of prices and policy variables.

1.1 A.1 Households

The representative household considers a set of state variables \(\left( K,Q_{1},Q_{2}\right) \), where K is aggregate capital, \(Q_{1}\) is the stock of diesel cars, and \(Q_{2}\) is the stock of gasoline cars; she does not internalize the costs of \({\text {CO}}_{2}\) emissions concentration, given by Z. The representative household’s problem can be written as follows:

with respect to C, H, I, \(K^{\prime }\), and\(\left\{ X_{j},{\tilde{N}} _{j},Q_{j}^{\prime }\right\} _{j=1,2}\), subject to the budget constraint

and the accumulation of capital and vehicles:

The wage W, the rental price of capital R, the government transfer TR, the dividend from the automotive industry \(\Pi \), all remaining prices \( \left\{ p_{Xj},p_{Fj}\right\} _{j=1,2}\), \(p_{MR}\) and taxes \(\left\{ \tau _{Fj},\tau _{Xj}\right\} _{j=1,2}\), are given to the household.

We require concavity on the instantaneous utility function \(u\left( C,S,H\right) \), where vehicle services S are given by the following CES specification:

In a recursive manner, the first-order conditions are

and